Help CleanTechnica’s work by a Substack subscription or on Stripe.

Or help our Kickstarter marketing campaign!

Canada has quietly shifted into a brand new section of EV centered industrial coverage, not by saying a dramatic ban or a sweeping mandate, however by altering the arithmetic that governs the automotive market. The federal authorities has moved away from express EV gross sales quotas and towards steadily tightening fleet common emissions requirements, paired with open credit score buying and selling and a deliberate commerce coverage alternative that permits giant volumes of low value electrical autos to enter the nation. Taken collectively, these strikes create a system the place outcomes are pushed by math moderately than slogans, and the place capital flows predictably towards whoever can ship the bottom emissions at scale.

The core change is the tightening of fleet common greenhouse fuel emissions requirements beginning within the late 2020s. As an alternative of requiring {that a} fastened share of autos offered be electrical, the coverage units a blended emissions goal throughout the whole lot a producer or importer sells in a given mannequin yr. Each Silverado, Equinox, Blazer EV, or imported crossover counts towards a single common. EVs depend as zero. Inner combustion autos depend at their licensed grams of CO2 per km. The usual tightens yearly, and whereas the precise publish 2026 curve has not but been revealed, a ten% yr over yr discount is in line with each worldwide benchmarks and the federal government’s acknowledged intent. Meaning a fleet common that may sit round 170 gCO2 per km in 2027 would want to fall to roughly 153 g in 2028, 138 g in 2029, and near 100 g by 2032.

This issues as a result of the compliance system is predicated on lifetime emissions, not annual tailpipe output. For gentle vehicles, which embody most SUVs and crossovers, the rules assume roughly 225,000 miles of lifetime driving. Credit are calculated because the distinction between the usual and precise emissions, multiplied over that lifetime distance. A zero emission automobile offered right into a fleet with a 170 gCO2 per km commonplace generates on the order of 60 tons of lifetime CO2 credit. Even at a extra conservative 150 g commonplace, the quantity remains to be round 55 tons. These usually are not summary numbers. They’re the items that get traded between corporations to stability compliance.

Basic Motors offers a helpful instance of how this performs out for a legacy producer. In 2025, GM offered roughly 300,000 autos in Canada, with the overwhelming majority being pickups and SUVs. EV gross sales have been about 25,000 items, or roughly 8% of quantity. Beneath present requirements, that blend ends in a compliance deficit that GM covers utilizing banked credit and bought credit, at a price that works out to roughly $500 to $700 per automobile relying on credit score costs. That’s manageable within the quick time period. The issue emerges as requirements tighten. Beneath a ten% annual ratchet, GM would want roughly 20% to 30% EV share by 2027 to keep away from shopping for credit, nearer to 40% by 2029, and greater than 50% by the early 2030s if the remainder of its fleet stays dominated by giant vehicles. At fixed gross sales of 300,000 items, that suggests transferring from 25,000 EVs to effectively over 100,000 inside a couple of years. The maths leaves little room for incrementalism.

On the similar time, Canada has layered commerce coverage on high of this emissions framework by permitting as much as 49,000 Chinese language constructed EVs per yr to enter the market at the usual 6.1% import obligation as an alternative of the beforehand introduced 100% surtax. These autos usually are not handled as a particular case in emissions accounting. If the Chinese language OEM is the importer of report, its Canadian gross sales are assessed identical to another producer’s fleet. Since these fleets are all electrical, they massively over adjust to the emissions commonplace and generate giant volumes of tradable credit.

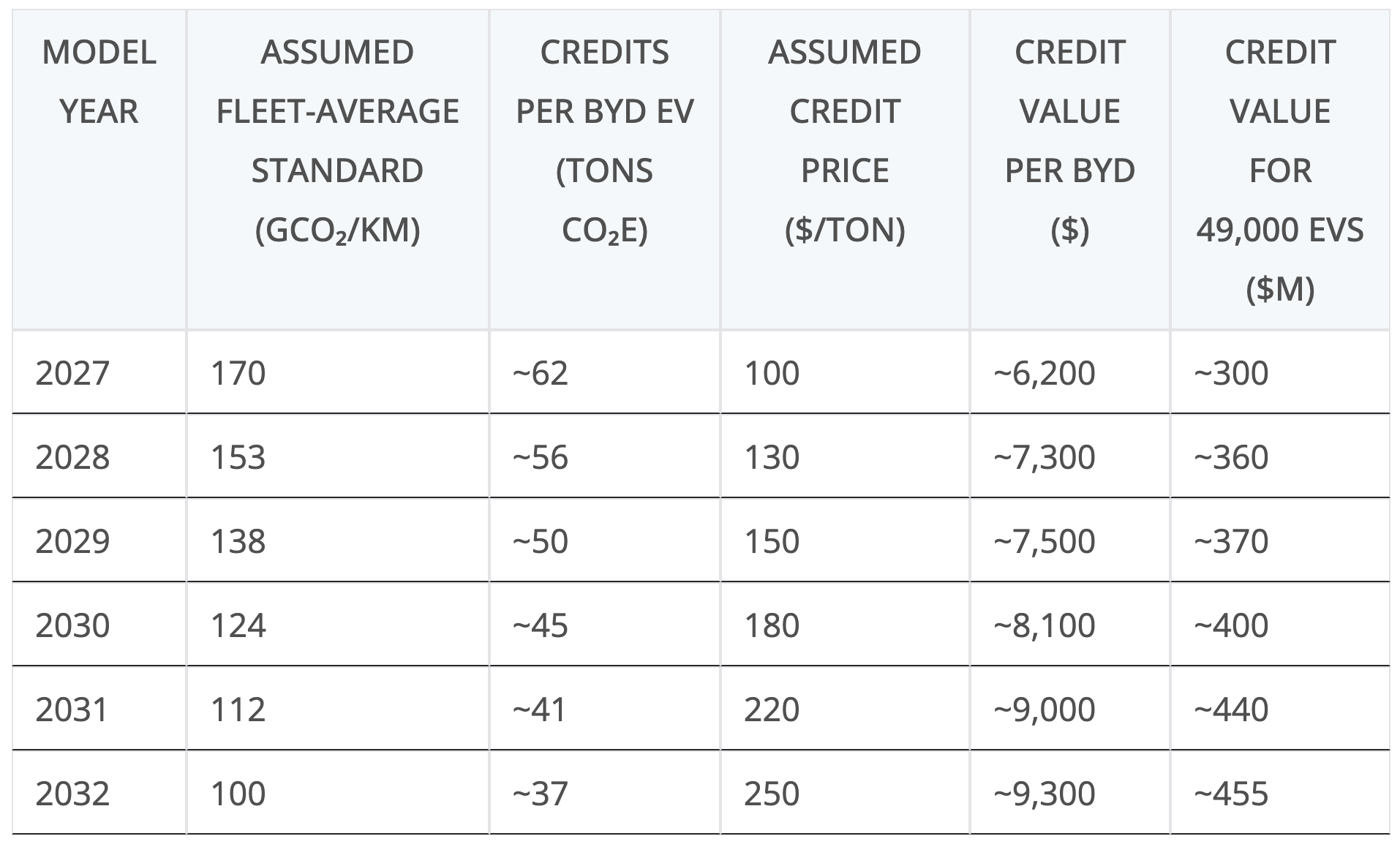

BYD is a consultant instance of how this modifications the economics for brand spanking new entrants. Take a small electrical SUV, much like the Atto 3, offered into Canada in 2027. As a crossover, it’s seemingly categorised as a lightweight truck for regulatory functions. At a 170 gCO2 per km commonplace, that single automobile generates roughly 62 tons of lifetime emissions credit. If credit score costs sit in a believable early tightening vary of $80 to $120 per ton, the credit score worth per automobile is roughly $5,000 to $7,400. Towards that, BYD pays a 6.1% import obligation. If the worth for obligation is $30,000, the tariff value is about $1,830. The online coverage pushed profit earlier than another prices or margins remains to be on the order of $3,000 to $5,500 per automobile.

Scaled as much as the total annual quota, the numbers develop into materials. Forty 9 thousand EVs producing roughly 55 to 62 tons of credit every interprets into 2.7 to three.0 million tons of credit per yr. At $100 per ton, that’s about $300 million in potential credit score worth. Even after paying roughly $90 million in import duties on $30,000 autos, the online stays effectively over $200 million. This isn’t a rounding error. It’s a structural income stream created by the interplay of emissions coverage and commerce guidelines.

Additionally it is essential to notice what isn’t taking place. These credit usually are not handed out by the federal government. They’re earned by promoting zero emission autos right into a tightening regulatory setting. They symbolize averted lifetime emissions in comparison with the usual. When Basic Motors or one other legacy OEM buys these credit, it isn’t subsidizing China in an summary sense. It’s paying for actual emissions reductions that it has not but delivered itself. The cash flows from companies with emissions intensive fleets to companies with clear fleets, precisely because the coverage is designed to encourage.

Over time, the stability shifts. Credit score costs are more likely to rise as requirements tighten and banked credit are exhausted. Cheap expectations place early costs within the $80 to $120 per ton vary, rising towards $150 to $250 by the early 2030s if EV adoption doesn’t speed up quick sufficient to flood the market with credit. At these ranges, per automobile compliance prices for lagging OEMs transfer from tons of of {dollars} to effectively over $1,000. Shopping for time turns into costly.

The strategic implication is simple. Canada has created a system the place legacy automakers pays for compliance within the quick time period, together with paying EV solely producers like BYD, however solely whereas they rebuild their product combine. The longer they delay, the more cash flows outward and the upper the eventual adjustment value turns into. There isn’t any steady equilibrium the place a truck heavy fleet can indefinitely purchase its approach out. The arithmetic closes that door.

Politically, this shift works in Carney’s favour. By eradicating the express EV gross sales mandate, he eliminates probably the most seen and simply attacked aspect of the earlier coverage framework. Mandates are easy to caricature and invite arguments about bans, client alternative, and authorities overreach. Changing that headline goal with a tightening emissions commonplace modifications the character of the controversy in a approach that’s far much less emotive.

What takes the mandate’s place is a market mechanism that’s more durable to argue with in public. Fleet-average emissions requirements and tradable credit body the transition as an final result to be achieved moderately than a behaviour to be enforced. Automakers usually are not instructed what autos to promote. They’re instructed the emissions outcome they have to meet, with flexibility in how they get there. Opponents are left arguing in opposition to emissions accounting and market pricing moderately than in opposition to an express quota.

This method additionally disperses political duty. If EV adoption accelerates, it may be attributed to falling costs, competitors, and innovation moderately than authorities compulsion. If legacy automakers complain about rising compliance prices, the response is that they maintain a number of choices, together with altering their gross sales combine, investing sooner, or shopping for credit from others. The state is not visibly choosing winners, although the construction clearly rewards zero-emission autos.

It additionally has the potential to drive the transition simply as shortly because the mandate it replaces, even when it seems to be softer on the floor. A steadily tightening fleet-average emissions commonplace produces the same final result as soon as the numbers drop beneath what inside combustion autos can plausibly ship at scale. At that time, the one sensible technique to comply is to promote a quickly rising share of zero-emission autos.

In apply, the stress might be stronger than a easy gross sales quota. A mandate fixes a share and leaves room for lobbying, delays, or carve-outs. An emissions commonplace that tightens yearly compounds. Annually of delay will increase the variety of EVs required later, whereas additionally rising the price of shopping for compliance from others. The arithmetic doesn’t pause, even when product cycles do.

As a result of the system costs lifetime emissions, the monetary sign is front-loaded. Credit symbolize many years of averted emissions, so shortfalls accumulate shortly and develop into costly. That creates an incentive to maneuver early moderately than watch for the final compliant yr. From an automaker’s perspective, lacking the curve by a couple of years might be much more expensive than lacking a one-time mandate goal.

The result’s that, whereas the coverage avoids the rhetoric of compulsion, it nonetheless delivers compulsion by economics. Automakers retain theoretical alternative, however the price of selecting to not electrify rises yr by yr. In that sense, the brand new framework doesn’t sluggish the transition. It channels it by market forces in a approach that may be simply as decisive, and in some instances extra relentless, than an express mandate.

There may be additionally an affordability narrative embedded within the shift that works to Carney’s benefit. By pairing emissions requirements with openness to lower-cost EV imports, the federal government can credibly argue that it’s increasing alternative moderately than constraining it. As an alternative of telling Canadians what they have to purchase, the coverage creates circumstances the place cheap electrical autos usually tend to be obtainable, together with fashions that home automakers have been sluggish to supply. That permits Carney to border the transition not as a sacrifice imposed on households, however as a technique to make cleaner transportation cheaper and extra accessible, a message that resonates much more broadly than local weather targets alone.

Lastly, the shift makes the coverage extra sturdy. A gross sales mandate might be repealed shortly by a future authorities. A market-based system embedded in rules, credit score banks, and multi-year compliance planning is way more durable to unwind with out creating disruption. As soon as corporations have internalised the emissions curve into their funding selections, reversal turns into expensive. In that sense, eradicating the mandate doesn’t weaken the coverage. It strengthens it by making it stick.

Publicly, the response from legacy automakers and their consultant organizations has been broadly optimistic. Teams such because the Canadian Car Producers’ Affiliation have welcomed the shift towards fleet-average emissions requirements as extra versatile and extra aligned with market realities. The emphasis of their statements is on optionality, predictability, and the flexibility to reply to client demand moderately than adjust to a set quota that might create stock danger.

That response displays a specific mind-set about value and danger. An emissions commonplace feels simpler to handle than a mandate as a result of it spreads obligation throughout your entire fleet and throughout time. Compliance is not binary in a given yr. As an alternative of lacking a share goal, corporations can partially comply and make up the distinction with credit. So long as credit score costs stay average, this converts what would have been a tough constraint right into a line merchandise. Within the late 2020s, paying a number of hundred {dollars} per automobile in credit score prices seems to be cheaper and fewer disruptive than accelerating platform transitions, retooling crops, or pushing EV volumes sooner than sellers imagine the market can take up.

There may be additionally consolation within the vary of levers obtainable. Beneath an emissions framework, legacy OEMs can lean on incremental effectivity good points, hybrids, modest combine shifts, and bought credit, moderately than relying virtually completely on EV gross sales development. That flexibility lowers perceived near-term danger and makes it simpler to reassure boards, buyers, and sellers that the transition might be paced and managed moderately than rushed.

The hazard is that this logic holds solely within the quick time period. The emissions commonplace tightens yearly, not each product cycle. Annually of slower EV uptake will increase the EV share required later and will increase the amount of credit that have to be purchased within the meantime. As a result of the system costs lifetime emissions, deficits accumulate shortly. What seems to be like a manageable working value within the late 2020s can develop into a structural value downside within the early 2030s as requirements tighten and credit score costs rise.

There may be additionally a collective blind spot. Credit score markets keep low cost provided that sufficient producers over-comply. If most legacy OEMs make the identical rational short-term alternative to purchase time as an alternative of accelerating EV gross sales, demand for credit rises sooner than provide and costs transfer accordingly. At that time, the emissions framework turns into dearer than the mandate it changed, not much less. The coverage provides legacy automakers flexibility, nevertheless it additionally expenses them for yearly they use it. Within the medium time period, that makes delay riskier than it seems in the present day.

What seems to be at first look like a group of disconnected insurance policies is in truth a coherent, if understated, industrial technique. Tighter emissions requirements create demand for credit. Open credit score buying and selling determines who will get paid. Commerce coverage decisions affect who provides these credit and at what value. The end result is that legacy OEMs should considerably up their EV sport, and till they do, they are going to be paying companies like BYD for the privilege of constant to promote excessive emitting autos in a market that has determined, quietly and numerically, to maneuver on.

Help CleanTechnica through Kickstarter

Join CleanTechnica’s Weekly Substack for Zach and Scott’s in-depth analyses and excessive degree summaries, join our every day e-newsletter, and comply with us on Google Information!

Have a tip for CleanTechnica? Need to promote? Need to counsel a visitor for our CleanTech Discuss podcast? Contact us right here.

Join our every day e-newsletter for 15 new cleantech tales a day. Or join our weekly one on high tales of the week if every day is simply too frequent.

CleanTechnica makes use of affiliate hyperlinks. See our coverage right here.

CleanTechnica’s Remark Coverage